Once you understand how to use them youll never need anything else. However they manage the risk properly.

Eur Usd Reversal May Ultimately Be The Product Of Risk Trends

Eur Usd Reversal May Ultimately Be The Product Of Risk Trends

Im folgenden wollen wir uns hiermit.

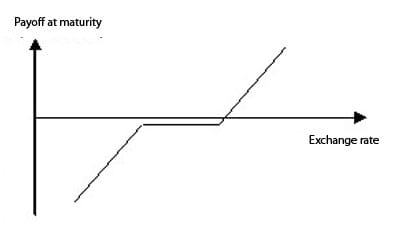

Forex risk reversal chart. One option is bought and another is written. There are 3 forex chart patterns ive used over the years to become profitable. Calls for different pairs over standard tenors.

! Risk reversal is a little known strategy in the stock options trading scene but a pretty common term in the forex options trading scene and the commodities options trading scene for its hedging power hence the name risk reversal. When trading with reversal patterns forex traders engage in a risky approach. As exemplified a money management system gives fabulous returns with reversal patterns.

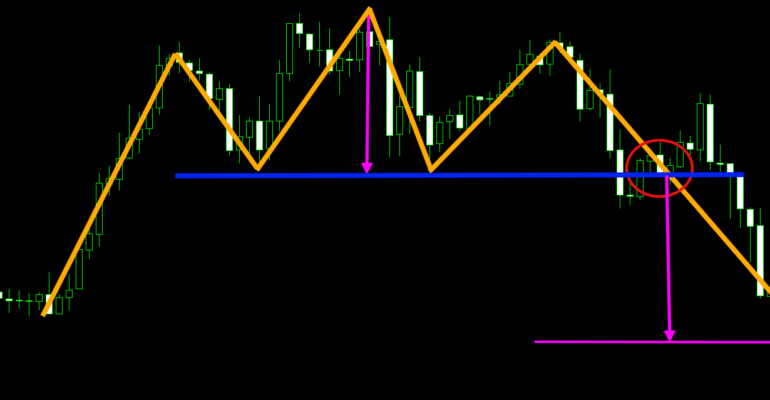

The only problem is i keep reading about them but cant actually find 1. I have been studying and read about risk reversal option charts for currencies. Forex reversal patterns are on chart candlestick formations of one or more candles or bigger chart patterns which forecast price reversals.

When the risk reversal hits its bottom 5 th percentile or below as it relates to previous 90 days go short. Haufig spreche ich im morning meeting live trading und acuh im zusammenhang mit dem commitment of traders report vom risk reversal an den fx o! ptionsmarkten. An overview of changes to at the money volatili! ties and the relative value of puts vs.

However they manage the risk properly. Accordingly the use of risk reversals can be implemented as part of a broader strategy. Risk reversals also known as protective collars have a purpose to protect or hedge an underlying position using options.

Every chart pattern has a mass sentiment component that can help a trader in gauging potential price swings. Accordingly the use of risk reversals can be implemented as part of a broader strategy. Therefore risk reversals are typically used a signal of potential future trading activity.

An otc volume index market pin risk table and selected volatility and risk reversal charts. Even though the name makes the strategy sound very sophisticated it really is a very simple options strategy with a very simple underlying logic. Forex options risk reversals breakout trading strategy entry rule.

If it hits its top ! 5.

Pivot Points With Shooting Star Reversal Pattern Forex Trading

Pivot Points With Shooting Star Reversal Pattern Forex Trading

Trading With No Indicators Or Naked Forex Trading

Trading With No Indicators Or Naked Forex Trading

Weekly Forex Review 20 No! vember 2017

Eur Usd Risk Reversals And Volatility Gauge Indicate The Eur May

-636711087464401201.png) Forex Market Live News Fxopen

Forex Market Live News Fxopen

Forex Chart Patterns You Need To Know Daily Price Action

Forex Chart Patterns You Need To Know Daily Price Action

The Best Most Important Forex Indicators For Traders

The Best Most Important Forex Indicators For Traders

How Average True Range Atr Can Improve Your Trading

How Average True Range Atr Can Improve Your Trading

Guide To Forex Options Trading Part 9 Risk Reversals Tradersdna

Guide To Forex Options Trading Part 9 Risk Reversals Tradersdna

Fx Options Risk Reversal

Fx Options Risk Reversal

Risk Reversal In Options

Risk Reversal In Options

3 Best Chart Patterns For Intraday Trading In Forex

3 Best Chart Patterns For Intraday Trading In Forex

Using Implied Volatility As An Indicator In Forex Article Contest

Using Implied Volatility As An Indicator In Forex Article Contest

Featured Trade Recent Rebound Of Japan 225 At Risk Of Downside Reversal

Featured Trade Recent Rebound Of Japan 225 At Risk Of Downside Reversal

Forex Channel Reversal Trading System Atoz Markets